What many people don’t know is that based on their income, age and family size, they may be eligible for a subsidy to help defray the cost of health insurance.

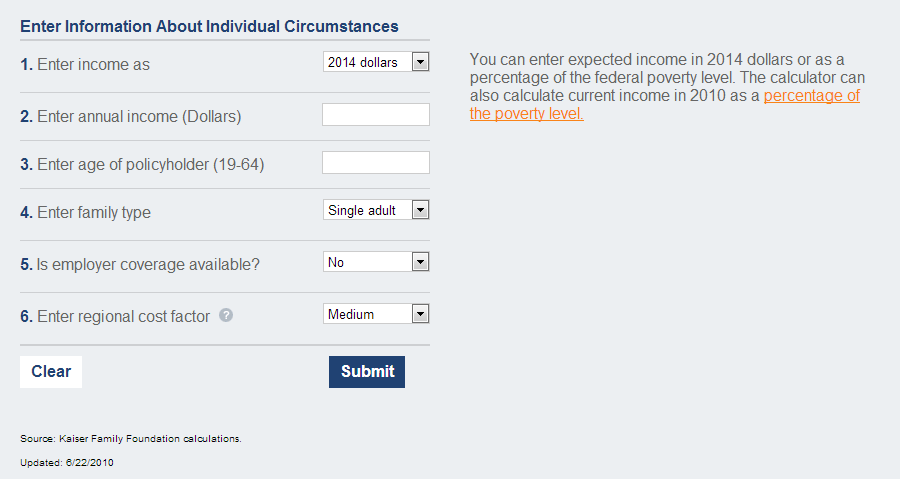

Here’s a handy calculator from the Kaiser Family Foundation that will help you see your healthcare insurance deal if you are without insurance now, or might be without insurance in 2014. The calculator site says:

“This tool illustrates premiums and government assistance under the health reform law signed by the President. Beginning in 2014, tax credits will be available for people under age 65 who purchase coverage on their own in a health insurance Exchange and are not covered through their employer, Medicare or Medicaid. The tool allows the user to examine the impact at different income levels, ages, family sizes, and regional costs.

Premium calculations are consistent with estimates of premiums under reform prepared by the Congressional Budget Office. CBO projects that average premiums under reform for the same level of coverage for a given group of enrollees would be 7-10% lower than under the status quo. However, in many cases coverage will be more comprehensive and accessible than what is typically available today in the non-group market. As a result, 2014 premiums in the calculator cannot necessarily be compared to what people buying insurance on their own are paying in 2010.

The calculator does not apply to people with coverage available through an employer, where the firm is generally paying for a substantial portion of the insurance premium.”

The calculator (see screen shot below) is simple to use and helps you to understand what your healthcare future might be in 12 months. Click here to go to the calculator.